From Albania to Uzbekistan, how governments have used income support measures to protect people and jobs during COVID-19

The pandemic has impacted the global economy on an unprecedented scale. This evidence scan compares and contrasts how different countries have attempted to mitigate the negative economic repercussions using a range of often-innovative income support measures

Authors: Martina Di Folco, Naomi Simon-Kumar, Andrew Wood, Tim Nusser, Toby Phillips and Tatjana Buklijas

Introduction

The COVID-19 pandemic has impacted the global economy on an unprecedented scale: per capita income has contracted, unemployment has increased, and most countries are experiencing economic recession (see World Bank, 2020; BBC, 2021; Shretta, 2020; Harari, Keep & Brien, 2021). In the midst of managing the pandemic and the economic downturn, governments have turned to different instruments.

This research scan explores how governments around the world have tried to mitigate the pandemic’s negative economic repercussions by focusing on income support measures. Relevant policies were collected through the Oxford Covid-19 Government Response Tracker (OxCGRT) and the International Network for Government Scientific Advice (INGSA) databases. While most countries have adopted income support measures in one or another, this scan contains a sample of what is available, and is not to be considered exhaustive of all policies used by governments.

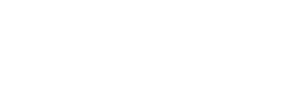

Figure 1. Maximum income support during the COVID-19 pandemic. Source: OxCGRT database

Our scan has found governments have used an array of different instruments to help their population cope with the effects of restrictions – primarily: wage subsidies or compensation, short-time work schemes, cash transfers, allowances and social security benefits, utility subsidies, loan repayment, and tax exemptions and refunds.

Several countries have provided wage subsidies or compensation to employees through their employers or companies, by covering part of their previous salaries and, in some cases, social security contributions. Self-employed people and sole entrepreneurs were often included in those who could seek relief when facing a significant loss of income compared with pre-pandemic times.

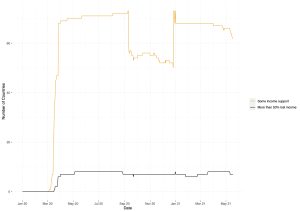

Figure 2. Number of countries providing some income support or more than 50% lost income over time

Other countries, such as Germany, have opted to institute or expand so-called short-time work schemes, which consist of employees maintaining their jobs but working at reduced hours, with the state covering at least part of their usual salaries – thus reducing the burden on employers without increasing unemployment (1).

Some countries – Austria, Cambodia and Hong Kong among them – have provided, in addition to other income support measures, direct cash transfers to different categories of citizens. Serbia, for instance, approved a universal cash transfer of €100 to all citizens aged 18 and above.

The majority of countries have expanded existing social security benefits, such as unemployment insurance, and created temporary ad hoc allowances to sustain their citizens during the pandemic. For instance, the Albanian government doubled unemployment and social assistance benefits, while in Aruba the government created an emergency social assistance fund (FASE).

Some governments, such as Belgium and the Netherlands, created temporary ‘bridging’ allowances to help people cope with the loss of work; these allowances have usually lasted between one and three months. Other countries, such as Canada and Uruguay, instituted allowances allowing those who had to suspend their work to self-isolate or care for a child or a family member to do so.

Countries including Bahrain, Malta, Singapore and Timor-Leste have provided subsidies to help their citizens pay for their rents, water and electricity bills. Monaco, on the other hand, created a €50 million credit guarantee fund to repay loans on behalf of entrepreneurs, artisans etc; while Russia has refunded taxes for those registered as self-employed.

Some countries have opted for long-term measures. Estonia approved an amendment to its 2021-2023 employment programme which allows companies impacted by COVID-19 to seek compensation (it remains to be seen whether this measure, or another similar provision, will be in place after 2023). In Chile, the government increased the emergency family income from 65,000 to 100,000 Chilean pesos, and has said this figure will remain for the foreseeable future. Meanwhile, Russia has permanently increased the maximum unemployment allowance from 8,000 to 12,130 rubles.

The remainder of this global scan offers fuller descriptions of notable income support policies implemented around the world, divided up into the following policy areas:

- Wage subsidies/compensation

- Short-time work schemes

- Cash transfers

- Allowances and social security benefits:

– Food assistance and allowances

– Education allowances, grants and loans - Utility subsidies

- Loan repayment

- Tax exemption and refunds

A brief country-by-country summary of policies can be found at the end of this article, in Table 1.

Wage subsidies/compensation

In Albania, the government approved a first economic package in March 2020 containing LEK 6.5 billion to support small and medium enterprises and the self-employed forced to close or declare inactivity due to the pandemic by paying out the minimum salary of ALL 26,000 (2).

In Arizona (USA), the governor expanded access to unemployment insurance – adding people who work at a business that has been temporarily closed or has reduced hours because of COVID-19, who have to quarantine because of COVID-19, or who have to care for a family member with COVID-19, to the list of people eligible for unemployment insurance (1).

In Aruba, the government approved a payroll support plan that covered up to 80% of employees’ salary for a maximum of Afl. 5,850 per month to help employers whose activities were impacted by COVID-19 (1).

In Azerbaijan, the government set up a compensation scheme to cover losses experienced by entrepreneurs and employees (1). The government covered employees’ salaries for an amount up to circa US$418 (712 manat).

In Bahrain, the government covered the salaries of private sector workers from April to June 2020 (1). Starting from July 2020, the government covered up to 50% of salaries of employees in the sectors most impacted by the pandemic (2); the measure was extended to the end of 2020 (3).

In Benin, the government covered up to 70% of employees’ salaries for a period of three months, reimbursed VAT tax credits, provided assistance for a total of FCFA 4.98 billion to artisans, self-employed, and micro-entrepreneurs whose activities were impacted by COVID-19 (1).

In Bulgaria, the government set up a wage subsidy scheme wherein the state covered up to 60% of employees’ insurance income and social security contributions for companies impacted by COVID-19 whose revenue declined by at least 20% compared to the same period of 2019 (1, 2). The measure was extended until September 2021. Employees working in businesses closed in the month of January 2021 were entitled to 75% of their salary, covered by the government.

In Canada, to mitigate the effects of the pandemic on businesses, the government proposed a three-month temporary wage subsidy scheme for small entrepreneurs with an allowance of up to CA$1,375 per employee and CA$20,000 per employer. Canada’s emergency wage subsidy rate was increased to maximum 75% of previous salary and extended until 13 March 2021 (1).

In Croatia, the government expanded its existing minimum wage payment scheme used by companies facing difficulties; the net minimum wage in April and May 2020 was raised from HRK 3,250 to HRK 4,000 (1, 2, 3, 4, 5). Employers whose businesses faced a loss of revenue of more than 50% could also receive HRK 2,000 plus social security contributions per employee. Sectors that were particularly hit by the pandemic (tourism etc.) were entitled to HRK 4,000 of support per employee if their loss of revenue was more than 60%. Entrepreneurs experiencing a loss of income or revenue between 40-60% are also eligible for relief.

In the Czech Republic, the government approved the ‘Antivirus’ employment protection programme aimed at covering employees’ salaries (1). Eligible companies can receive wage compensation depending on average gross wages, mandatory contributions and other conditions. Additional support for entrepreneurs that had to close their activities due to the October lockdown of CZK 400 per employee was approved at the start of 2021 (2).

In Denmark, the government set up a temporary wage compensation scheme between March and June 2020 wherein the state covered up to 75% of employees’ salaries for those who were at risk of dismissal due their companies’ decreased revenue during the pandemic. Those with hourly wages received 90% wage compensation for a maximum of DKK 26,000 per month. Between 9 December 2020 and 30 June 2021, employers can seek compensation from the state for any furloughed employees due to COVID-19 that they would have otherwise laid off (2). Employers can apply for a wage compensation of up to 75% for salaried employees and 90% for non-salaried employees. All compensations can be of a maximum of DKK 30,000 per full-time employee. The government provided the same support for companies that had to close during lockdown between 9 December 2020 and 12 April 2021.

In Estonia, the government approved an amendment to the 2021-2023 Employment programme that allows companies who have been affected by COVID-19 restrictions to seek compensation (1). The amendment institutes a wage compensation scheme for those employees whose workloads or wage have significantly decreased and self-employed people whose income has decreased. The total cost of these measures is estimated around €38 million for regular employees and €4.66 million for self-employed people. Companies whose revenue has decreased by at least 50% compared to the average monthly revenue between December 2019 and February can seek wage support subsidies (2). The Estonian unemployment fund reimburses up to 60% of employees’ salaries for a maximum of €1,000 per month. Self-employed people can receive up to €584 if their income has decreased by at least 50% in 2020 compared to 2019.

In Greece, for the months of August and September 2020, employers in the sectors most impacted by the pandemic (tourism, hospitality, etc.) were able to benefit from a temporary contract suspension scheme. The scheme allowed employers to suspend contracts for all their staff, without firing them, with the state providing them with an allowance of €534 (2).

In Hong Kong, the government introduced a wage subsidy scheme covering up to 50% of employees’ previous salaries for a maximum of HK$18,000 (2, 3).

In Ireland, the government launched a COVID-19 income support scheme in March 2020 that established a temporary wage subsidy of 70% of take home pay with a maximum tax free amount of €410 per week. In April 2020, the Temporary wage subsidy scheme (TWSS), instituted at the end of March 2020 to help workers whose employers have been negatively impacted by the pandemic, was amended to increase the subsidy for those earning up to €412 per week from 70% to 85% of their previous net weekly pay. For those earning between €412 and €500 per week, the subsidy was set to a maximum €350 per week. For those earning more than €586 per week, a tiered system applied according to the amount paid by the employers and the level of reduction in pay.

In Israel, the Cabinet approved the ‘Safety net 2020-2021‘ economic plan in July 2020. The plan included full take home pay compensation for wage earners on unpaid leave until the end of June 2021 or until the unemployment rate remains above 10%. In the eventuality that unemployment will decrease below 10%, the compensation will become 75% of take home pay.

In Latvia, the government covered 75% of salary for workers whose workplaces had to close or declare inactivity because of COVID-19 (1). The government covered amounts up to €700, not subject to payroll taxes. Later in 2020, the government expanded its support measures (2). Self-employed people, those that receive royalties, and people whose activities have suffered a decline in profits or income of at least 20% compared to the 2019 August-October trimester were eligible for support of up to 75% of lost income for an amount not exceeding €1,000. Self-employed people paying the micro-enterprise tax were eligible for 50% of average monthly income for the third quarter of 2020. Employees working at companies affected by the pandemic were eligible for idle-time payments between €330 and €1,000 per month.

In Lithuania, the government approved a €5 billion economic plan to support jobs and income. It provided employees whose workplaces declared inactivity due to COVID-19 a monthly salary of €607. The state also made subsidies for 70% (up to €910.5) and 90% (up to €607) of employees’ salaries, ad hoc subsidies for vulnerable and disabled workers, and self-employed workers.

In Luxembourg, the government aimed at avoiding redundancies by covering 80% of the salaries of employees whose workplaces had to declare closure or inactivity due to force majeure / coronavirus (1).

In Monaco, the government introduced an “Exceptional minimum income” of €1,800 for self-employed people that had their income reduced because of the pandemic (1). In August 2020, the government extended the temporary provisions, which cover salaries for workers whose sectors have been affected by restrictions for a minimum of 80% (2). The measure has a cost of circa €9 million per month (3).

In the Netherlands, the government approved an economic package that implemented a temporary scheme allowing companies facing difficulties during the pandemic to apply to the National insurance agency for an allowance that would cover up to 80% of their employees’ salaries for three months (1). Another allowance called ‘temporary bridging scheme for flexible workers’ (TOFA), intended for flexible workers who lost at least 50% of their income due to the pandemic, was cancelled at the end of July 2020 (2). Moreover, the government set up a Temporary bridging scheme for independent entrepreneurs (TOZO) aimed at self-employed people who experienced a loss of income because of the pandemic (3). Starting from the next round of applications (1 April 2021–30 June 2021) the allowance will be means tested.

In Norway, the government also approved a scheme to compensate for up to 50% of lost income organizers and subcontractors of cultural events that were cancelled because of the pandemic (1). A similar scheme providing up to 70% or 50% of lost income was also approved for the sports and volunteering sectors (2).

In New Zealand, employers and sole traders could apply to the Wage subsidy scheme to aid with paying their employees. The scheme provides NZ$585.80 for people working 20 hours or more and NZ$350 for those working up to 20 hours.

In Poland, the government approved a PLN 35 billion package to support companies during COVID-19. Companies can apply for subsidies according to their size, number of employees, and loss of revenue to help cover salary costs.

In Qatar, the Ministry of Administrative Development, Labour and Social Affairs (MADLSA) issued guidelines regarding procedures to follow during COVID-19, stipulating that workers who were required to quarantine, self-isolate, or are receiving treatment were to be paid their basic salary and receive their allowance regardless of whether they were eligible for work or health benefits (1).

In Romania, the government covered 75% of the salary of employees sent into technical unemployment due to the pandemic affecting their companies (1).

In Saudi Arabia, the government covered 60% of salaries in private sector industries affected by COVID-19 (1). Companies could also apply for aid for an amount up to 9,000 Saudi riyals.

In Singapore, in May 2020 the government approved a ‘Fortitude budget‘ containing an extension of the Job support scheme (JSS) that included the extension of the scheme of 1 month; the possibility for companies struggling after the relaxation of lockdown restriction to apply for further coverage of 75% employees’ salaries until August 2020; increased support for certain sectors (i.e., aerospace, marine etc) to 50% or 75% of salaries. The FY2021 budget includes an extension of wage subsidies under the Job support scheme for a total of SG$2.9 billion (2).

In Serbia, employees of small and medium enterprises and entrepreneurs were guaranteed payment of the statutory net minimum wage (RSD 30,367, circa €258), employees of large private sector companies were guaranteed payment of 50% of the net minimum wage for three months (1). Unemployed people also received an allowance (2). A second economic package included the payment by the state of up to 60% of wages for workers whose companies were facing difficulties, the postponement of taxes and contributions on wages for one month (3). The measures cost circa 66 billion dinars. A supplementary budget approved in April includes the extension of wage subsidies and additional relief for workers in the travel, hospitality, and art sectors (2).

In the Seychelles, employers or self-employed people could apply for state assistance in paying their employees for an amount between the minimum wage up to SR 30,000 per month (1).

In Slovakia, the government provided wage compensations to employees of businesses affected by the pandemic, the self-employed, and individuals with no income (1).

In Slovenia, the government introduced a wage compensation scheme for cases of enforced quarantine or force majeure, covering up to 80% of employees’ salaries (1, 2). Self-employed people, partners in firms and farmers were provided a monthly basic income and partial reimbursement in case of quarantine of up to €1,100, except for workers in the cultural sector, who received €700.

In Timor-Leste, the government provided wage subsidies covering up to 60% of previous salaries for formal sector workers (1).

In Turkey, the government provided up to 60% wage compensation for a period of three months to any company forced to close or declare inactivity due force majeure (1).

Short-time work schemes

In Austria, the government set up a Corona Short-time work (CoronaKurzarbeit) scheme to deal with the effects of the pandemic on workers and employers (1). The short-time work scheme entails a reduction of working hours by employees, who will be paid up to 90% of their usual salary by their employer. The employer will subsequently be reimbursed by the state. The scheme was extended with the FY2021 budget until at least the end of the year (2).

In Canada, the government set up a work sharing programme where workers who agreed to reduce their working hours would receive benefits.

In Croatia, the government introduced a short-time work programme financed by the EU SURE fund (1, 2, 3). The programme provided HRK 2,000 per employee who reduced their working hours plus social security contributions.

In Denmark, between September to December 2020 the government implemented a short-time work scheme enabling employers to reduce employees’ working hours between 20% and 50% with the state covering salary costs for a maximum of DKK 23,000 per month (1).

In Germany, the government extended its short-time work programme, where employers who reduced working hours for at least 10% of their employees without firing them were entitled to wage compensation by the state (1). Initially, childless employees received 60% of their previous salary, while employees with children 67%. For employees receiving wage compensation for more than four months and working at least 50% less than before the pandemic, the short-time work allowance was raised to 70% of previous salary for childless employees, and 77% for employees with children. Compensation was to be increased to respectively 80% and 87% if employees were receiving the allowance for seven months. These changes were valid until 31 December 2020. The scheme has been extended to a maximum of 24 months (2).

In Greece, the government launched a programme called COOPERATION sponsored by the EU SURE fund (1). The programme provided wage compensation for employees of companies that lost at least 20% in revenue due to the pandemic. The state covered up to 60% of previous salaries, while employers were obliged to reduce work hours instead of laying off employees.

In Hungary, the government introduced a short-time work scheme where the state subsidizes up to 70% of employees’ salaries for three months if employers reduce their working hours instead of firing them (1). From April 2021, half of the wage of the subsidised worker was reimbursed up to one and a half times the current minimum wage. The state also waives tax contributions which cover about two-thirds of wages (2).

In Sweden, the government approved short-term layoffs schemes in which the central government covers three-quarters of the cost of staff reducing their working hours (2).

Cash transfers

In Austria, the government implemented a one-off supplemental payment to unemployment benefits of €450 over a period of three months (3).

In Azerbaijan, unemployed people received a lump-sum between 190 and 300 manat as part of a social measures package (2).

In Bulgaria, in October 2020 the government provided almost 30,000 farmers compensation for damages due to COVID-19 for a total amount of €30 million (3).

In Cambodia, the government established a programme providing cash handouts to the poorest households in the country estimated to be circa 560,000 comprising 2.3 million people. The handouts were carried out in June and July 2020, subject to expansion and extension depending on need. The scheme cost US$25 million a month. The scheme was later extended to 50,000 additional households (1).

In Canada, the government provided a one-off payment of CA$400 and CA$600 for low- and middle-income single individuals and couples was approved for the month of May 2020.

In Hong Kong, the government provided every permanent resident aged 18 and above with a cash transfer of HK$10,000 (1). Self-employed people received a lump sum of HK$7,500 (2).

In Iceland, at the end of April 2021, the government has announced that those who have been unemployed for 14 months or more will receive a one-off payment of ISK 100,000 (1).

In Serbia, the government approved a one-off payment to all pensioners and a universal cash transfer of €100 to all citizens aged 18 and above (1). A supplementary budget approved in April includes a universal cash transfer of €60 to all citizens aged 18 and over; a one-off payment of €50 to all pensioners; and a one-off payment of €60 to all the unemployed (1).

In the United States, the Coronavirus Aid, Relief, and Economic security (CARES) act included a cash transfer of US$1,200 to Americans who earned up to US$75,000 in 2019 (1). In December 2020, Congress approved a new stimulus package that provided Americans who earned up to US$75,000 in 2019 with a US$600 cash transfer (2).

Allowances and social security benefits

In Albania, the government’s March 2020 economic package doubled unemployment and social assistance benefits. A further LEK 7billion was approved in April 2020 to support those who were left out in the first package by providing a one-off transfer of LEK 40,000 to those who had lost their job or were made redundant.

In Andorra, in June 2020 the government approved an extension of extraordinary paid leave for self-employed workers who had to be absent from work to care for their children due to the pandemic (1). Those eligible received an allowance of up to €1,083.

In Aruba, the government implemented an emergency social assistance fund (FASE) of up to Afl. 950 per month for employees; and an allowance of up to Afl. 4,000 per quarter for employers (1).

In Azerbaijan, the government made available allowances for micro and private entrepreneurs between US$147 and US$2,941 (250–5,000 manat) (1).

In Belgium, the government extended temporary unemployment benefits by making it possible for them to be granted automatically and raising the percentage of salary covered from 65% to 70% (1). Self-employed people who had to close their activities or were facing difficulties could claim a monthly “transitional allowance” (droit de passerelle) allowance between €1,291.69 and €1,614.10. The allowance was later doubled according to family status of recipients: individuals without family responsibilities received €2,583.40 per month, while those with family responsibilities received €3,228.20 per month (2, 3). The allowance was extended until June 2021 (4).

In Bermuda, the government provided an unemployment benefit with a duration of up to twelve weeks of a value of up to $500 per week for employees and self-employed people affected by COVID-19 (1, 2).

In Bhutan, the government created a relief fund to support people affected by COVID-19 with an allowance of Nu 10,000 per month, scaled down to Nu 7,000 per month from July until September 2020 (1).

In Bulgaria, self-employed people and employees working in the transport, hospitality, and tourism sector were entitled to a contribution of BGN 290 per month (1).

In Cambodia, in its fifth stimulus package the government extended support for private-sector employees, particularly those in the garment, textiles, and footwear industries with monthly subsidies.

In Canada, the government set up a temporary income support measure for workers and parents without sick leave that had to stay at home to care for children or relatives with an allowance of up to CA$900 paid bi-weekly for a maximum of 15 weeks. Moreover, it instituted an emergency support benefit for those who lost their jobs or whose working hours were cut for a total of CA$5.5 billion. The government also increased the maximum annual Canada child benefit by CA$300 per child. Moreover, the FY2021 budget extended the maximum eligibility period for the Canada recovery benefit from 38 to 50 weeks (2).

In Chile, the government increased the emergency family income from 65,500 to up to 100,000 Chilean pesos per person with no formal income. Those with a formal income below 100,000 Chilean pesos received the difference needed to reach that amount. The amount received by each family will not change in time unless the socioeconomic situation worsens and it will need to be revised upwards. The scheme was extended to all older adults who receive a basic solidarity pension and or a solidarity pension contribution lower than a basic solidarity pension (2).

In the Czech Republic, self-employed people who had to suspend work to care for a child between 6 and 13 years of age were provided with a paid leave of CZK 500 per day (1). Moreover, self-employed people could, under certain conditions, qualify for a one-off compensation bonus of CZK 25,000.

In Finland, the government temporarily raised the amount of exempt unemployment benefit, as in the amount that is not taken into account when calculating benefits, from €300 to €500 per month (1). The increase is aimed at part-time or short-time workers in the agriculture, horticulture sectors and others. The government also introduced a temporary financial assistance allowance of €723.50 per month to cover unpaid leave from work until June 2020 (2, 3). Until the end of December 2020, self-employed people could seek a labour market subsidy if their full-time employment had ceased and their income due to the pandemic was no more than €1,089.67 (4). The subsidy has been extended until September 2021 (5).

In Honduras, the government provided contributors to the private contribution regime for pensions (RAP) and maquiladora workers a temporary solidarity contribution of 6,000 Lempiras per month for three months (1, 2). The contribution is composed of 2,000 Lempiras from the employer, 1,000 Lempiras from the government, and 3,000 Lempiras from pension contributions workers have deposited in the RAP. For maquiladora employees, the contribution will be 3,500 Lempiras from the state and 2,500 Lempiras from the company.

In Hong Kong, the government provided a supplemental allowance to eligible social security recipients for an overall cost of HK$4.225 billion (1).

In Ireland, the government launched a COVID-19 income support scheme in March 2020 that provided an emergency COVID-19 pandemic unemployment payment (PUP) of €350 per week to those who lost their jobs or were self-employed; and it increased the COVID-19 illness payment to €350 per week.

In Iceland, the government’s US$1.6bn COVID-19 response package included the possibility for part-time workers to claim up to 75% of unemployment benefits. Those whose jobs were at risk were also eligible to claim unemployment benefit and claim additional relief from the government. Moreover, the government has decided in its resilience package to pay a 2.5% supplement to unemployment benefits in addition to an increase of 3.6% as set out in the 2021 fiscal budget proposal. Unemployment benefits would amount to ISK 307,403 per month. Job-seekers and their children also benefited from an increase in existing benefits. At the end of April 2021, the government has announced that extension of income-linked unemployment benefits to six months will be extended until 1 February 2022 (1).

In Israel, the Cabinet approved the ‘safety net 2020-2021‘ economic plan in July 2020. The plan also established an immediate relief grant for business owners and self-employed people of a maximum of NIS 7,500 and a social assistance stipend for those among them that have an annual taxable income of up to NIS 640,000 that have seen a 40% decrease in income of up to NIS 15,000. Those who have received unemployment benefits for at least 100 days between 1 March and 17 October 2020 received a grant of 2,000 shekels if their wage before the pandemic was lower than the average daily wage (1). From May 2021, citizens also have access to the ‘assistance grant for self-employed and managed employees’ if their loss of income in March-April 2021 amounted to at least 40% compared to the same period of 2019 (2).

In Lao PDR, the government covered up to 60% of workers’ salaries if they were part of the social security scheme and had their job suspended during May and June 2020 (1).

In Luxembourg, the government provided self-employed people with an emergency allowance of €2,500 plus additional financial aid between €3000-4000 depending on income as part of its economic stabilisation programme. In 2020 the allowance for low-income groups affected by the pandemic was doubled.

In Malta, the government approved an economic package that included: an allowance of €350 for employers per employee on quarantine leave; additional two months paid family leave allowance of €800 per month; an allowance of €800 for workers working in sectors impacted by restrictions. Moreover, an allowance of €800 was also guaranteed for self-employed people working in the same sectors. The same allowance was also provided to disabled people who could not work from home but had to self-isolate due to complications that may arise from COVID-19 and their disability.

In Norway, temporary amendments to unemployment benefits included the possibility for employees to retain 100% of their pay up to 6G, where G indicates the basic amount of national insurance (1G amounts to NOK 99,858). Unemployment benefits for those who were laid off or lost their jobs was raised to 80% of their pay if their income was up to 3G and to 62.4% if their income was between 3G and 6G.

In New Zealand, the government approved a COVID-19 income relief payment in May 2020 meant to help those who lost their job due to the pandemic. The scheme was available for 12-weeks and paid NZ$490 to those who lost full-time employment and NZ$250 for those who lost a part-time position.

In Russia, the government decided to permanently increase the maximum unemployment allowance from 8,000 to 12,130 rubles. The maximum allowance was originally changed in March 2020 to aid workers who lost their jobs due to COVID-19 (1). Workers on unemployment benefits will receive 75% of their earnings for the first three months but no more than 12,130 rubles, while for the following three months they will receive 60% of their earnings, but no more than 5,000 rubles.

In Singapore, at the end of January 2021, the Ministry of Social and Family Development (MSF) launched the COVID-19 recovery grant (CRG) aimed at supporting low- and middle-income employees and self-employed people affected by the pandemic. The scheme entails an allowance of up SG$700 per month for employees who are unemployed due to retrenchment or involuntary contract termination, or placed on involuntary no-pay leave (NPL) for at least three months consecutively. The scheme also provides an allowance of up to SG$500 for employees who are experiencing a loss of income of at least 50% on average for at least three months consecutively, or self-employed people who are facing a loss of net trade of at least 50% on average compared to the same period in 2019 or 2020.

In the Solomon Islands, members of the national provident fund were provided with a sum of $5,000 if they were under the age of 50 and temporarily laid off or repatriated due to COVID-19 (1).

South Korea relaxed requirements for national healthcare payments for the bottom 40% of income earners, and the bottom 50% of income earners in areas most affected by COVID-19 (1). Those eligible saw their national health care contributions reduced by 30% for the three-month period. People were also able to defer national pension fund payments for 60 months.

In Sweden, the government, in partnership with other political parties, introduced a temporary supplementary allowance of up to SEK 1,325 for families with children eligible for housing allowance (1). High-risk groups and their families were also able to apply for an allowance of up to SEK 804 per day in case they had to stop going to work to avoid getting infected (2).

In Thailand, the government approved cash support of THB 5,000 for three months for workers not registered in the social security system (1). Registered workers received 50% of their previous salary, not exceeding THB 15,000 per month, in the eventuality they lose their job. Farmers and entrepreneurs affected by the pandemic could also seek the same form of assistance. In January 2021 the government approved a further US$7 billion total in cash handouts of THB 3,500 per month per person for low-income people (welfare-card holders, farmers and informal sector workers) (2, 3).

In Timor-Leste, the government provided US$100 cash transfers to households facing difficulties for three months and US$25 cash transfers for basic food items to eligible households for a period of two months (1).

In Togo, the government implemented a mobile cash-transfer programme, called NOVISSI, aimed at supporting informal workers (1). Recipients received a grant of at least 30% of the minimum wage, with pay-outs ranging from CFAF 10,500 to 20,000.

In Turkey, the government introduced a short-term employment allowance, ranging from TL 1,752 to 4,381 (1).

In Uruguay, the government allowed workers aged 65 and above to self-isolate at home for a maximum of 30 days while receiving a sickness benefit covering 70% of their previous income not exceeding 44,606 Uruguayan pesos (1). In May 2020 the government approved an extension of unemployment benefits until September 2020 (2). Moreover, allowances provided by the Uruguay social card and the Equality plan were doubled (3). The government also instituted a special unemployment benefit for a period of 90 days for employees facing suspension of work or reduction of working hours (4).

In the United States, the Coronavirus Aid, Relief, and Economic security (CARES) act provided states with funding to give out up to 13 weeks of Pandemic emergency unemployment compensation (PEUC) within the regular framework of unemployment insurance (1). Until the end of July 2020, allowances were determined by states and integrated by US$600 federally. In December 2020, Congress approved a new stimulus package that boosted federal unemployment insurance by US$300 (2).

Food assistance and allowances

In Sri Lanka, low-income households were provided essential food items at concessionary rates (1).

In Burma, families who recently lost their incomes because of the pandemic were provided with free basic food items (1).

In the United States, $500 million was provided in support to the Special Supplemental Nutrition Program for Women, Infants, and Children, for pregnant women and mothers laid off due to COVID-19. $400 million was directed to The Emergency Food Assistance Program (TEFAP) which purchases and distributes food to low-income Americans. $100 million was allocated to the US Department of Agriculture to provide food assistance grants to the Northern Mariana Islands, Puerto Rico, and American Samoa, and through the U.S. Department of Health and Human Services, $250 million to Aging and Disability Services Programs for food assistance, including home-delivered nutrition services and services for Native Americans. Extra SNAP (food stamp) benefits were put in place that allowed flexibility in application and reporting requirements, and removed work requirements for food stamp (SNAP) recipients for the duration of the national public health emergency. (1)

Education allowances, grants and loans

In Colombia, $2.5 billion was allocated through the National Guarantee Fund (FNG) for lines of credit that leverage the payment of payroll for private higher education institutions (1). An additional $200,000 million fund was provided to higher education institutions to sustain support schemes for undergraduate students in conditions of socioeconomic vulnerability. A major Solidarity Fund for Education was created, including several measures: a line of credit guardians for private school payments; expansion of the Icetex (Ministry of Education National Funding entity) Relief Plan for the education sector; financing for the enrolment of vulnerable students in school programmes (2).

Fiji suspended Tertiary Loan Repayments (1).

Norway increased access to loans for students who lost work income due to the pandemic (1).

Utility subsidies

In Bahrain, the government subsidised the payment of water and electricity bills for both individual citizens and companies (1).

In Benin, the government provided a subsidy for all citizens for electricity and water bills for a total amount of FCFA 5.76 billion (1).

In Hong Kong, the government paid one month’s rent for low-income people living in public housing (1).

In Ireland, the government launched a COVID-19 income support scheme in March 2020 that provided protections for those struggling with regular payments such as mortgages, rent or utility bills.

In Malta, the government approved an economic package that expanded rent subsidies.

In Monaco, the government cancelled commercial rents for state-owned properties (1).

In Russia, the government suspended rent payments to governmental institutions until the end of 2021 (1).

In Singapore, the government also approved measures to aid households cope with difficulties during COVID-19 (1). A one-off Solidarity utilities credit of SG$100 was available to help pay utility bills.

In Timor-Leste, the government provided subsidies for the payment of utilities for low-income households (1).

In Togo, the government subsidised water and electricity usage for three months for groups paying social tariffs (1).

Loan repayment

Belgium allowed the reduction of prepayment for self-employed (1).

In Monaco, the government created a €50 million credit guarantee fund to repay loans on behalf of entrepreneurs, artisans, etc that were facing difficulties paying their dues because of COVID-19 (1).

Tax exemption and refunds

Belgium allowed delays and exemptions of employer’s social security contributions payments, including for self-employed persons (1). Moreover, several support schemes were instituted, including: payment plan for VAT, payment plan for withholding tax, and payment plan for personal/corporate tax (2).

In China, individuals working to prevent and control COVID-19 were exempted from personal income tax. Medical supplies issued to people to assist with symptoms of COVID-19 were not included in wages and salaries and are tax exempt (1).

A range of tax relief measures were introduced in Fiji, including: the removal of stamp duties on mortgages, export income deduction increases for 3 years, deferment of the VAT Monitoring System, 300% tax deduction allowed to employers for wages/salary paid to employees, no duty and VAT on importation of medical products (1)(2).

Germany deferred tax payments for affected persons. The charging of interest on deferral was generally waived, with no late payment surcharges collected (1).

Greece suspended income tax obligations for four months (1).

Ghana introduced an incentive package for health workers, allowing all health workers to pay no income tax for a period of three months (1)(2).

India extended income tax return deadlines (1).

In Luxembourg, taxpayers were entitled to cancel advance tax payments for the first two quarters of 2020, covering income tax and municipal business tax. Taxpayers were given up to four months to pay deferred tax charges, without incurring interest (1)(2).

Panama delayed tax payment deadlines for 120 days with no extra interest fees or surcharges. Small- and medium-sized companies were exempt from paying income tax for the year (1).

In Russia, those registered as self-employed were refunded their taxes for 2019 and received a partial refund of 2020 taxes; sole proprietors of economic activities also received a partial refund on their social contributions (1). Additionally, the government suspended rent payments to governmental institutions until the end of 2021 (1). Healthcare workers and physicians working during the pandemic are exempt from personal income tax (2).

In South Africa, taxpayers who donated to a national solidarity fund were entitled to claim up to 10% of their taxable income (1).

Saudi Arabia deferred tax payments (2).

South Korea introduced a comprehensive financial support package, including: 7 trillion won to provide financial and tax support for families and businesses affected, including 50% income tax cuts given to landlords for rent reduction and individual consumption tax cuts for car purchases to boost consumption (1).

Thailand reduced corporate income tax for investments in the medical sector (4).

Uzbekistan delayed income tax payments and allowed interest-free repayments for individuals and businesses whose activities were affected due to the pandemic (1).

In Arizona (United States), the governor extended income tax deadlines (1).

Table 1: Summary of policies

| Country | Summary |

| Albania | Paid out an ALL 26,000 salary to employees and self-employed people facing difficulties and doubled unemployment and social assistance benefits. One-off payments to the newly unemployed. |

| Arizona | Extension of income tax deadlines. Extended access to unemployment insurance for individuals affected by the pandemic. |

| Andorra | Extraordinary paid leave to self-employed caring for their children. |

| Aruba | Payroll support that covered up to 80% of employees’ salary. Emergency social assistance fund for employees and employers. |

| Austria | Short-time work scheme. One-off unemployment benefits for three months. |

| Azerbaijan | Allowances for small entrepreneurs. Payroll support covering employee salaries. Lump-sum payments to the unemployed. |

| Bahrain | Payroll support of up to 50% of salaries for certain sectors. Subsidies for electricity and water bills (for both individuals and businesses). |

| Belgium | Increased unemployment benefits with looser eligibility criteria. Transitional allowance for self-employed. Personal and corporate tax payment plans. Deferral and exemptions for employer social security contribution payments. Reduction of prepayments for self-employed. |

| Benin | Payroll support of up to 70% for three months. Financial support for the self-employed. Subsidies for electricity and water bills. |

| Bermuda | New unemployment benefits for three months, incl. for the self-employed. |

| Bhutan | Allowances for individuals affected by COVID-19. |

| Bulgaria | Compensation to farmers. Monthly allowances to self-employed and workers in certain sectors. Payroll support for certain companies. |

| Burma | Provision of free basic food items to families who recently lost income due to the pandemic. |

| Cambodia | Subsidies for private-sector employees. One-off payments for poorest households. |

| Canada | Allowance for workers that took time off work to care for children or relatives. Increase in child benefits. One-off payments for low- and middle-income households. Short-time work scheme. |

| Chile | Minimum emergency income increased and extended to pensioners. |

| China | Individuals working in covid prevention and control exempted from income tax. Medical supplies tax exempt. |

| Colombia | Financial support measures for educational institutions, including private institutions, parents, and students. |

| Croatia | Expanded net minimum wage payment scheme. Financial support to certain businesses. |

| Czech Republic | Extraordinary paid leave to self-employed caring for their children. One-off compensation bonus for self-employed people. Wage subsidy scheme for businesses. |

| Denmark | Short-time work scheme. Financial incentives for not laying off employees. |

| Estonia | Compensation for affected companies. Wage compensation for self-employed and regular employees. |

| Fiji | Range of tax relief policies. Suspension of Tertiary Loan Repayments. |

| Finland | Raise in exemption limit for unemployment benefits. Temporary assistance to cover unpaid leave. Allowance for self-employed individuals not able to work. |

| Germany | Substantial benefit increases to the pre-existing short-time work scheme. Deferral of tax payments for affected persons. |

| Ghana | Income taxes for health workers suspended for three months. |

| Greece | Furlough scheme with lump-sum allowances for workers in certain sectors. Short-time work scheme. Income tax obligations suspended for four months. |

| Honduras | Lump-sum payment to contributors to the private pension scheme. |

| Hong Kong | Wage subsidy scheme covering up to 50% of salaries. Rent subsidies for low-income households. Allowance for social security recipients. Lump-sum payment to all adults with additional payments to the self-employed. |

| Hungary | Short-time work scheme. Waiver for certain tax contributions. |

| Iceland | One-off payment to individuals unemployed for 14 months or more at the end of April 2021. Unemployment benefits increased and extended to part-time workers. |

| India | Extension on income tax return deadlines. |

| Ireland | Temporary wage subsidies. Pandemic unemployment payment to newly unemployed or self-employed. Protections against those struggling with regular payments such as mortgages, rents, and utility bills. |

| Israel | Subsidies for workers on unpaid leave. Tiered lump-sum payments to business owners and self-employed. Additional payment to the unemployed. |

| Lao P.D.R. | Wage subsidies for furloughed workers (formal sector only). |

| Latvia | Wage subsidies for furloughed workers from certain businesses. Financial support for the self-employed. |

| Lithuania | Wage subsidies for furloughed workers from certain businesses. |

| Luxembourg | Wage subsidies for furloughed workers from certain businesses. Financial aid to the self-employed. Advance tax repayment cancellations. Deferral of tax without interest charges. |

| Malta | Expanded rent subsidies. Allowance for employees on quarantine leave. Extended family leave. Financial aid to the self-employed. |

| Monaco | Extraordinary minimum income for self-employed. Cancelled commercial rents for state-owned properties. Credit guarantee fund for businesses. |

| Netherlands | Wage subsidies for certain businesses. Temporary support to self-employed. |

| New Zealand | Wage subsidy scheme for businesses. |

| Norway | Substantially increased unemployment benefits. Increased access to loans for students. |

| Panama | Delayed tax payment deadline with no extra interest fees or surcharges. Small and medium sized companies are exempt from paying income tax for the year. |

| Poland | Wage subsidy scheme for certain businesses. |

| Qatar | Basic allowance in addition to salary for quarantined or sick workers. |

| Romania | Wage subsidies for furloughed workers. |

| Russia | Increase in unemployment allowance. Suspension of rent payments to governmental institutions. Exemptions from personal income tax for healthcare workers. |

| Saudi Arabia | Wage subsidy scheme for businesses. Direct aid to certain businesses. Deferral of tax payments. |

| Serbia | Wage subsidy scheme for certain businesses. One-off payment to all adults, with additional payments to pensioners and unemployed individuals. |

| Seychelles | Wage subsidy scheme for certain businesses and self-employed individuals. |

| Singapore | Wage subsidy for furloughed workers, unemployed and self-employed individuals. One-off subsidy for utility bills. |

| Slovakia | Wage subsidy scheme for certain businesses and self-employed individuals. |

| Slovenia | Wage subsidies for quarantined workers. Monthly basic income for self-employed, farmers, and partners in certain firms. |

| Solomon Islands | Lump-sum payment to furloughed or newly unemployed individuals below the age of 50. |

| South Africa | Up to 10% of taxable income claimable for individuals who donated to national relief fund. |

| South Korea | Tax support package for affected families and businesses. National health care payment contributions reduced for low-income individuals. National pension fund payment deferrals. |

| Sweden | Short-time work scheme. Additional allowance for families receiving housing allowance. Allowances for high-risk groups who had to stop going to work. |

| Sri Lanka | Provision of essential food items at concessionary rates to low income families and individuals. |

| Thailand | Lump-sum payments to informal workers. Partial wage replacement for newly unemployed, farmers, and entrepreneurs. Corporate income tax is reduced for investments in the medical sector. |

| Timor-Leste | Wage subsidies for workers (formal sector only). Subsidies for utility payments and cash transfers to low-income households. |

| Togo | Cash transfers to informal workers. Subsidised water and electricity bills. |

| Turkey | Short-time work scheme. Wage subsidy scheme for certain businesses. |

| Uruguay | Wage subsidies for individuals above 65 on unpaid leave. Extended unemployment benefits. Increased benefits to low-income individuals. |

| United States of America | Expanded food assistance programmes for low-income and vulnerable populations. Expanded unemployment insurance and provided one-off cash transfers. |

| Uzbekistan | Deferral of income tax payments. Interest-free repayments for affected individuals and businesses. |