Self-Employment Dwindles Amid the Cost-of-Living Crisis

As the COVID-19 crisis has made way for inflation and skyrocketing energy prices, the self-employed have not yet found their way out of the recent economic adversities. And many of them are now finding their way out of self-employment.

Robert Blackburn, Maria Ventura

While the UK population is recovering from the pandemic, the breathing space expected for the economy did not last long. Once again, economically, the self-employed seem to be suffering disproportionately – many doubting whether their business can survive. With Stephen Machin, director of LSE’s Centre for Economic Performance, we ran a survey in November 2022 to document how the self-employed are emerging from the impact of COVID-19 and dealing with the cost-of-living crisis. This followed five earlier surveys between May 2020 and May 2022, allowing us to see how the self-employed have fared from the beginning of the COVID-19 crisis until today.

No rest for the self-employed

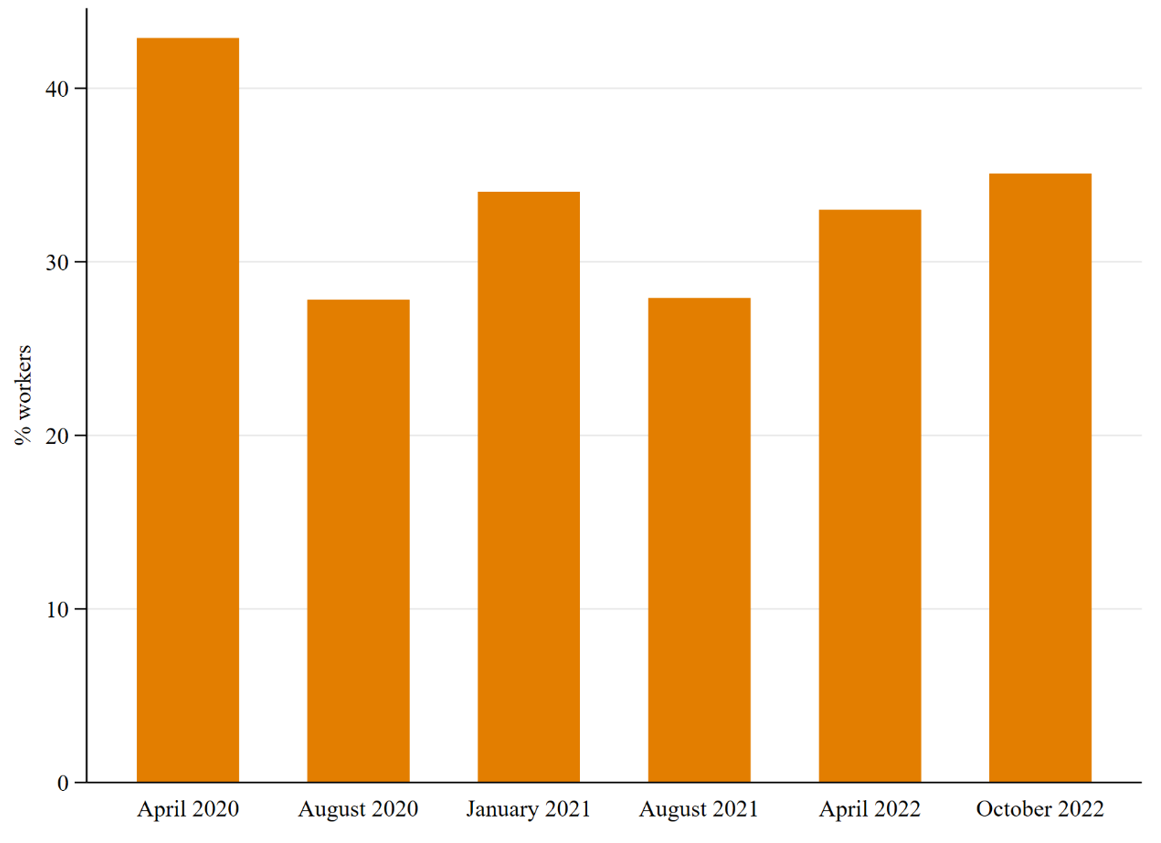

The past three years have seen the number of self-employed workers drop by 16 per cent, with the economic downturn experienced during the COVID-19 pandemic responsible for driving many out. In recent months, the numbers leaving self-employment have not been matched by incomers. This is no surprise, given that decreasing incomes in the sector are hardly making it an attractive employment option: our latest survey results reveal that in October 2022 the share of self-employed making less than £1,000 a month was 12 percentage points higher than before the pandemic, and four percentage points more than the previous year. As their finances deteriorate, the self-employed also encounter more difficulties in balancing their budgets. Figure 1 displays the share of self-employed having trouble paying for basic expenses in different months. The question has been asked in all six of our surveys and even though this proportion has decreased since the beginning of the pandemic, financial difficulties remain a major concern for a third of the self-employed.

Even though the effects of COVID-19 are less salient, the UK economy is gripped by new challenges and the self-employed in particular are experiencing severe difficulties. Recent reports on the UK economy have shown how inflation and the soaring costs of energy are causing widespread concern among businesses. Almost a quarter doubt whether their business will survive the next months. Our survey data confirms these findings, with rising costs of energy reported as the main issue for 45 per cent of self-employed workers, followed by business costs, including raw materials and labour (26 per cent). In this context, the plan by the government to cut energy costs through the Energy Bill Discount Scheme from April 2023 has been received with disappointment. In fact, the new scheme will replace the Energy Bill Relief Scheme (EBRS) which, being more generous, has allowed many businesses facing difficulties to stay afloat.

Figure 1. Share of self-employed experiencing financial difficulties

Source: LSE-CEP Surveys of UK Self-employment May 2020, September 2020, February 2021, September 2021, May 2022, and November 2022.

Current financial difficulties threaten pension savings

Ensuring an adequate income in retirement is particularly relevant for the self-employed who are not guaranteed such benefits that come from having an employer. On top of the basic state pension, an entitlement for all workers paying National Insurance contributions, most employees receive a workplace pension to which their employer usually also contributes. This type of pension scheme is, by definition, unavailable to the self-employed although they can contribute to a personal pension scheme. As a result, it is estimated that the self-employed receive a pension income that is on average 56 per cent lower than employees.

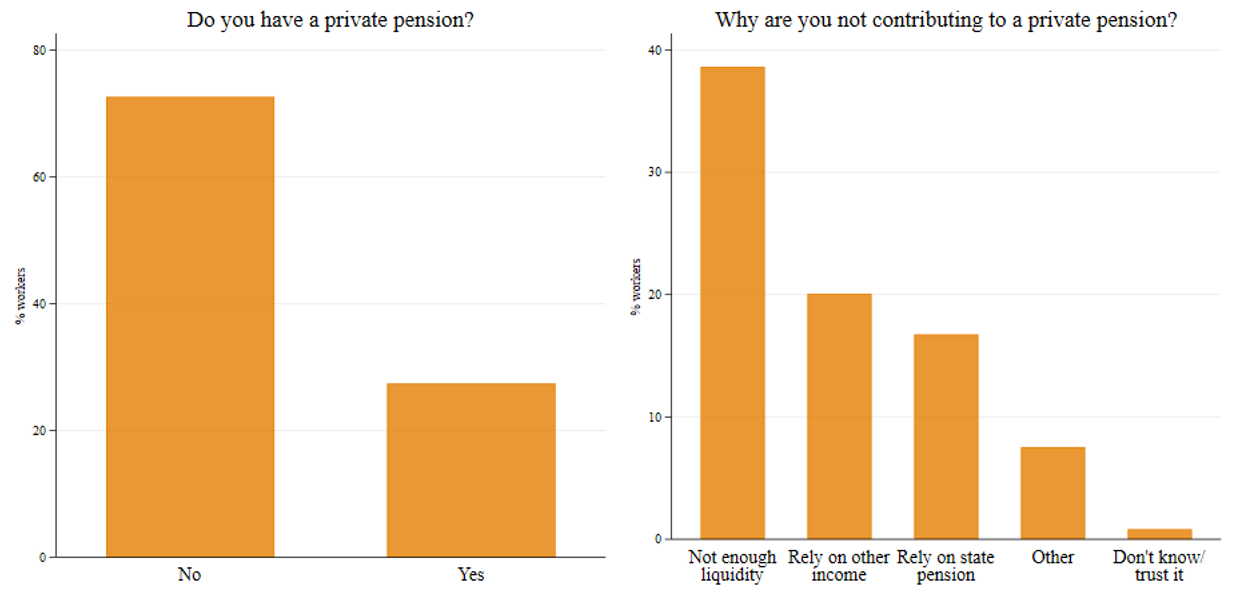

The availability of private pension plans has not, however, closed the gap between employees and the self-employed. Indeed over the last 10 years, the number of self-employed contributing to a private pension scheme has been decreasing. In our latest survey, we asked the self-employed if they are contributing to an additional personal pension. Figure 2 shows that 73 per cent of self-employed do not currently pay into additional pensions. The main reason for not doing so is a lack of income. Moreover, for the same income category, those who are solo self-employed and/or who have entered self-employment more recently are less likely to be paying into a private pension.

We explored the alternatives to paying into a personal pension scheme, one in which the government would make some form of matched contribution. When eliciting the willingness among the self-employed to pay for an additional pension we find that, for a hypothetical scheme in which the government would match workers’ contribution at a rate of three per cent of earnings, one third of the self-employed with incomes below £10,000 would take up the scheme at a proposed contribution rate of five per cent. This share increases to almost half of the group with a higher typical income of over £10,000 prepared to sign up.

Figure 2. Self-employed and private pensions

Source: LSE-CEP Survey of UK Self-employment November 2022

The self-employed are turning left

Last year was particularly eventful in terms of UK politics. Multiple changes in the leadership of the Conservative party, together with the frail economic climate resulted in decreased confidence in the Government. Political poll results of those eligible to vote show that support for the Conservative party has dropped by more than 50 per cent since the beginning of the COVID-19 pandemic, and Labour has been ahead in the polls for the last year.

Traditionally, the self-employed have tended to vote for Conservative and centrist parties, as historically they speak for the interests of enterprise and business. However, small business owners have started feeling ignored by the Conservatives and are now likely to seek political representation elsewhere or not at all. In our survey we asked self-employed workers which party they would be likely to vote for in a general election. The responses are overwhelmingly in favour of the Labour party (supported by 38 per cent), while Conservative support was 14 percentage points lower. The discontent and distrust in the government and politicians is also reflected by a significant 16 per cent who reported they would not vote at all. Our analysis found that young, solo self-employed workers would be less likely to vote in a general election than any other group. The self-employed who report being “worse off” as a result of the COVID-19 crisis reported that, conditional on them voting, would be more likely to vote Labour.

With the next general election possibly two years away it is still uncertain how well current polls will be translated into future votes. Nevertheless, a change in political views is likely to follow the growth of the gig economy and the prevalence of flexible work arrangements, especially among young people. Ultimately, this new direction in voting intentions may be a reflection of the structural change in the composition of the self-employed, moving away from a thriving group that characterised the past years, towards a more precarious and unstable form of employment.

This blog post is based on the CEP Covid-19 analysis paper From Covid-19 to collapse? – the self-employed and the cost of living crisis

It was originally published on the LSE website and is reproduced here with permission from the blog’s authors.